Estimated reading time: 7 minutes

Key Takeaways

- The descending channel is a bearish chart pattern essential for forex traders.

- Formed by two downward sloping parallel trendlines indicating sustained selling pressure.

- Helps traders identify potential sell signals and develop effective trading strategies.

- Various trading strategies include trading breakouts, trading within the channel, and incorporating indicators.

- Effective risk management is crucial when trading descending channels.

Table of contents

The descending channel chart pattern is a crucial tool for forex traders, providing insights into bearish market trends. This technical analysis formation assists traders in identifying and capitalising on downtrends, offering clear signals for potential trades. In this comprehensive guide, we’ll delve into the nuances of the descending channel pattern, also known as a falling channel, and how you can use it to enhance your trading strategy.

Understanding the Descending Channel

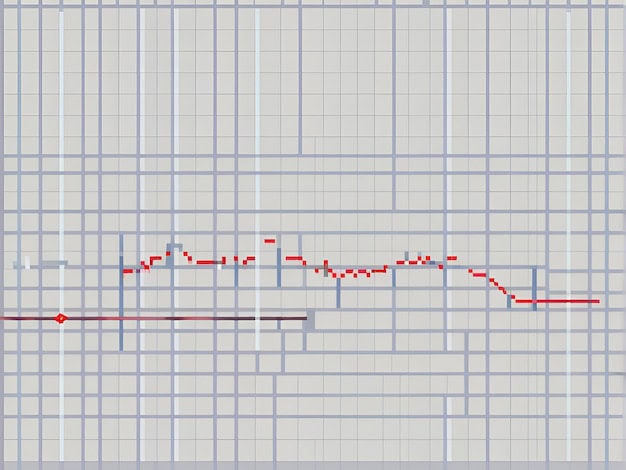

A descending channel is a chart pattern where the price is confined between two downward sloping parallel trendlines. This formation occurs during a downtrend and is characterised by a series of lower highs and lower lows. Let’s examine the key components:

- Upper Trendline (Resistance): This line connects a series of lower highs, acting as a resistance level where selling pressure intensifies.

- Lower Trendline (Support): This line connects a series of lower lows, serving as a support level where buying interest may temporarily halt the decline.

The consistent formation of lower highs and lower lows within the channel indicates sustained selling pressure in the market. This pattern provides traders with a visual representation of the ongoing battle between buyers and sellers, with sellers maintaining the upper hand.

Key Terminology

- Lower Highs: Peaks that are lower than the preceding highs, indicating weakening bullish momentum.

- Lower Lows: Troughs that are lower than the preceding lows, signalling strengthening bearish pressure.

Understanding these elements is crucial for accurately identifying and trading the descending channel pattern.

Formation of the Descending Channel

The descending channel forms through a series of price movements that create a clear downtrend. Here’s how it typically develops:

- Initial Downtrend: The market begins to show signs of bearish sentiment, with prices consistently closing lower.

- Lower Highs and Lower Lows: As selling pressure persists, each rally fails to reach the previous high, while subsequent declines push prices to new lows.

- Parallel Trendlines: Traders can draw two parallel trendlines connecting the lower highs (resistance) and lower lows (support), forming the channel boundaries.

- Consolidation: Within the channel, periods of consolidation may occur where price moves sideways but remains within the established boundaries.

To confirm the pattern, it’s essential to have at least two contact points on each trendline. This helps establish clear channel boundaries and increases the reliability of the pattern.

The role of consolidation in forming descending channels is significant. These periods of sideways movement allow traders to identify the channel more clearly and prepare for potential breakouts or continuation moves.

Significance in Technical Analysis

Recognising descending channels is crucial in technical analysis for several reasons:

- Predicting Market Movements: The pattern aids in forecasting continued downtrends, signalling persistent selling pressure.

- Trend Reversal Signals: A breakout from the channel may indicate a potential trend reversal, particularly if price breaks above the upper resistance line.

- Comparison with Other Bearish Patterns: Unlike patterns such as the descending triangle, which features converging lines, the descending channel’s parallel trendlines offer unique insights into price behaviour.

Breakouts are particularly significant in descending channels:

- Bearish Continuation: A break below the lower support line suggests a continuation of the downtrend.

- Bullish Reversal: A break above the upper resistance line may signal a potential trend reversal and the start of an uptrend.

Trading Strategies Using Descending Channels

Traders can employ several strategies when working with descending channels:

Trading the Breakout Strategy

- Enter a short position when price breaks below the lower trendline (bearish continuation).

- Enter a long position if price breaks convincingly above the upper trendline (bullish reversal).

- Confirm breakouts with increased volume or other technical indicators to avoid false signals.

Trading Within the Channel

- Sell near the upper trendline (resistance) and take profits near the lower trendline (support).

- Use tight stop-loss orders above the upper trendline to manage risk.

Utilising Price Action

- Look for candlestick patterns near the trendlines to identify optimal entry and exit points.

- Combine price action signals with the channel pattern for more accurate sell signals.

Incorporating Indicators

- Use technical indicators like RSI or MACD to confirm momentum and overbought/oversold conditions.

- Moving averages can help validate the overall trend direction.

Remember, no strategy is foolproof, and it’s crucial to combine these approaches with solid risk management practices.

Risk Management and Best Practices

Effective risk management is essential when trading descending channels:

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses. Place them above resistance for short trades or below support for long trades.

- Avoiding False Breakouts: Be cautious of false breakouts by waiting for confirmation, such as a candle closing beyond the trendline.

- Combining Multiple Indicators: Use other forms of analysis to validate trading decisions and improve accuracy.

- Backtesting: Test your strategies using historical data to refine your approach and build confidence.

- Emotional Discipline: Stick to your trading plan and avoid making emotional decisions. Maintaining a trading journal can help track performance and refine strategies over time.

Advantages of Trading Descending Channels

Trading descending channels offers several benefits:

- Clear Entry and Exit Points: The pattern provides well-defined support and resistance levels, allowing for precise trade planning.

- Anticipation of Market Movements: Traders can predict downtrends and potential reversals, aligning trades with prevailing market sentiment.

- Favourable Risk-Reward Ratios: The pattern allows for setting tight stop-losses with potentially larger profit targets, improving overall risk management.

Common Mistakes to Avoid

Be aware of these common pitfalls when trading descending channels:

- Misidentifying the Pattern: Volatile price action or insufficient data can lead to incorrect identification. Ensure trendlines are truly parallel and there are enough contact points.

- Overreliance on the Pattern: Don’t depend solely on the descending channel without considering other market factors or fundamental analysis.

- Ignoring Confirmation Signals: Waiting for confirmation can prevent premature entries and reduce the risk of false breakouts.

- Poor Risk Management: Neglecting proper risk management practices can lead to significant losses. Always set appropriate stop-loss and take-profit levels.

Conclusion

Mastering the descending channel chart pattern is a valuable skill for forex traders. This powerful technical analysis tool helps identify downtrends and enhance trading strategies. By understanding its formation, significance, and associated trading techniques, you can make more informed decisions in the forex market.

Remember, successful trading requires continuous learning, practice, and disciplined risk management. Incorporate the descending channel pattern into your analysis toolkit, but always use it alongside other technical and fundamental factors for a well-rounded approach to forex trading.

Additional Resources

To further your understanding of descending channels and technical analysis:

- Explore books and articles on technical analysis and chart patterns from reputable sources.

- Utilise charting platforms like TradingView to practice identifying patterns in real-time.

- Join trading forums or groups to share knowledge and stay updated on market analysis.

- Consider taking online courses or tutorials to deepen your understanding of forex trading strategies.

By continually educating yourself and refining your skills, you’ll be better equipped to navigate the complex world of forex trading and capitalise on opportunities presented by patterns like the descending channel.

FAQs

What is a descending channel in forex trading?

A descending channel is a bearish chart pattern formed by two downward sloping parallel trendlines that contain price action within a downtrend, indicating sustained selling pressure.

How can I trade using the descending channel pattern?

You can trade breakouts by entering short positions when price breaks below support or long positions when price breaks above resistance. Trading within the channel involves selling near resistance and buying near support.

What are the risks associated with trading descending channels?

Risks include false breakouts, misidentifying the pattern, and overreliance on technical analysis without considering fundamental factors. Effective risk management is essential.

Can a descending channel indicate a trend reversal?

Yes, a breakout above the upper resistance trendline of the descending channel may signal a potential bullish trend reversal.

What indicators can complement the descending channel pattern?

Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages can help confirm momentum and trend direction.